Understanding escrow payment on online marketplaces

What is escrow payment?

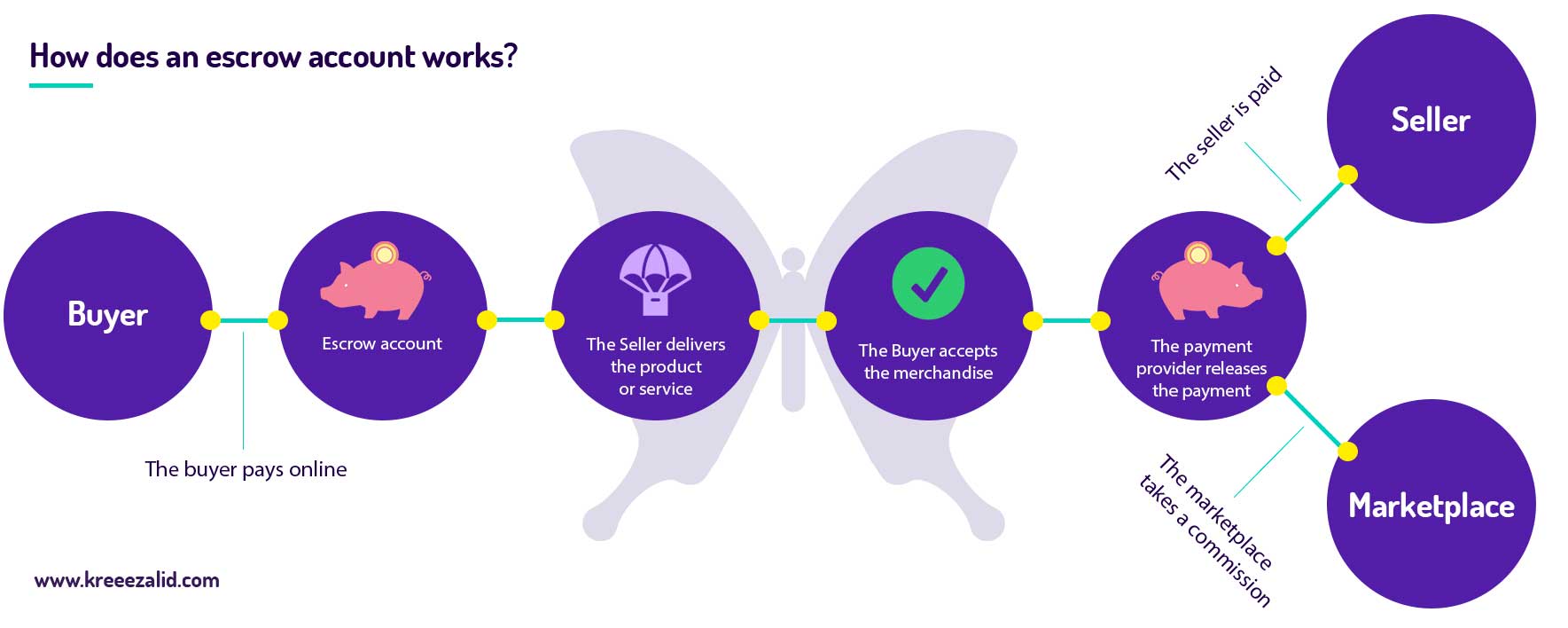

Escrow is an agreement between two people or organizations in which money is kept by a third person or organization until a specific condition is met. On online marketplaces, the customer will pay the goods or services by transferring money to a third-party solution. The money is placed in escrow until the order is completed. Then to money is transferred to the supplier (minus the marketplace’s commission if the platform charges service fees).

How does an escrow account work?

Why do you need an escrow account on your online marketplace?

As a marketplace, you are a trusted third party and you need to be able to act in case of a risk of a delayed delivery, a dispute, or if there’s the possibility of a refund being needed. Unlike, e-commerce websites you don't want to make a direct payment to the vendor because you're not the vendor and in case of a refund being needed you won't be able to act on the money.

You now understand why direct payment solutions, like Paypal, how popular they can be, cannot be a suitable system for a marketplace business.

Escrow payments with Kreezalid

Kreezalid integrates 2 specific payment providers to allow you to have this system on your marketplace:

Stripe with Stripe Connect. Kreezalid allows platforms to specify payouts for Custom Connect accounts via Stripe Connect

Mangopay

With these two payment providers on Kreezalid, the payment method will be debit card payment.

Important: Officially, Stripe does not support escrow accounts. However, they do provide escrow-like behavior through manual payouts. This gives you influence over payout timing, with the ability to delay payouts to Custom accounts for up to 90 days. The right setup has already been made for you and there is nothing you have to do technically to make it work on your Kreezalid marketplace. You can learn more about manual payouts here: About Stripe Connect Payouts.

Updated on: 17/03/2023

Thank you!